Memo From Frank

OK, we’re starting a new year. If things are not going like you want financially, why not take a more aggressive path this year and start on the road to financial security with a billboard sign portfolio? It does not take much to improve your standard of living. If you can build just one wooden billboard in 2014, that would give you an extra $200 to $300 per month in your pocket. Think of what you could do with that extra boost. Need more? Then why not build 10 signs and get an extra $2,000 to $3,000 per month in the bank. The most important thing is to do something. Make this the year in which you started building your portfolio of signs, and then let fate guide you to how big it ends up. There’s no time like the present to begin.

How A Few Billboards Are Infinitely Better Than A Bunch Of Savings

The concept that the average American can save up enough to retire is one of the great lies of all time. The average American has less than $25,000 in total savings. And 20% are upside in their mortgage. The cost of everything goes up continually (remember $1 gasoline) and programs like Obamacare help to push up household expenses by 20% at a time. So we are all in fantasy land to think that you can possible save enough – and live a normal life – to support any type of retirement.

And what would you do with the savings?

CD rates in the U.S. pay out at the rate of around 1%. So even if you saved $100,000, the interest on that would only be $1,000 per year. How in the heck can you retire on that? Just to illustrate the great “savings for retirement” fraud, let’s change the playing field and assume you have $1 million in savings (that would put you in the top 10% in the U.S.). The interest on that is only $10,000 per year – big deal! The bottom line is that the concept is a joke, and we all need to abandon that business model in search of something more realistic.

The billboard alternative

The billboard alternative A single wooden billboard can make around $3,000 per year. You would need $300,000 in savings to make that much at the current CD rate of return of 1%. Now which do you think is easier: to build one wooden billboard or save $300,000? Or let’s say you need $40,000 per year to retire. That’s around 13 wooden billboards vs. saving $4 million. Of course, the secret weapon that billboards have over savings is the rate of return on investment. A wooden billboard costs about $3,000 and earns about $3,000 per year – that’s a 100% return on investment per year. A CD does 1%. So the wooden billboard has a 100 times higher yield than a CD. That’s why so few can match so much in savings.

Plus the billboard has other advantages

Unlike the CD, the billboard has inflation protection, in that the rents can go up with the other prices in inflationary times. Another advantage of the billboard is that it’s value can grow as traffic increases, and as the market develops, whereas a CD never goes up. But probably the biggest difference is that you get satisfaction and entertainment from the interaction with people that the billboard provides. There are more than just material gains from the feeling of accomplishment from making a business run.

Conclusion

If you have already figured out that the “savings concept” is a con, then expand your horizons and start build your retirement foundation on billboard bedrock. It’s really hard to save money, but building and operating billboards is a breeze by comparison.

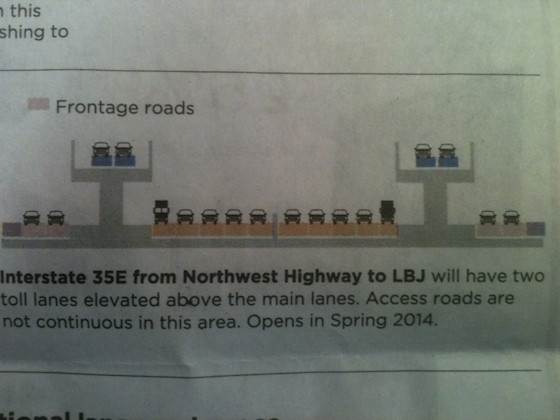

Ouch: The Dangers Of Big City Billboards

Dallas is about to renovate LBJ Freeway again – the highest traffic count road in the city. But the plans are not very happy if you own billboards on this highway. As you can see in these renderings, the new plans will obliterate the visibility of many of the existing billboards from the travel lanes. Adding elevated lanes will create a visual barrier and you will no longer be able to see many billboards. I’m sure that news of this design has created many a temper tantrum at Clear Channel, CBS and Lamar, which own most of the affected billboards. You can imagine the horror of losing some of your most valuable signs in the Dallas/Ft. Worth market, where rents often range from $5,000 to $10,000 per four weeks. How could this have been avoided? There’s really nothing that the sign owners could have done differently. But it illustrates the dangers of big city billboards. Things like this don’t happen on typical highways. But when you start hitting traffic counts over 250,000 cars per day, then roads can get re-developed into revolutionary arrangements that can knock out your sign. So if you built these signs from scratch, then you’re fine if they lose their visibility. And if you bought them during a recession at a low price and recouped your money already, then there’s no reason for alarm. But if you just bought one for $1 million, then you’re screwed. That’s the harsh reality of playing the urban billboard game.

Billboard Home Study Course

![]() How to Find a Billboard Location

How to Find a Billboard Location

![]() How to Buy a Billboard

How to Buy a Billboard

![]() How to Build a Billboard

How to Build a Billboard

![]() How to Operate a Billboard

How to Operate a Billboard

![]() How to Rent Ad Space on a Billboard

How to Rent Ad Space on a Billboard

![]() How to Sell a Billboard

How to Sell a Billboard

Get Your Copy Now!

The Market Report

Prices Are Delayed By At Least 15 Minutes